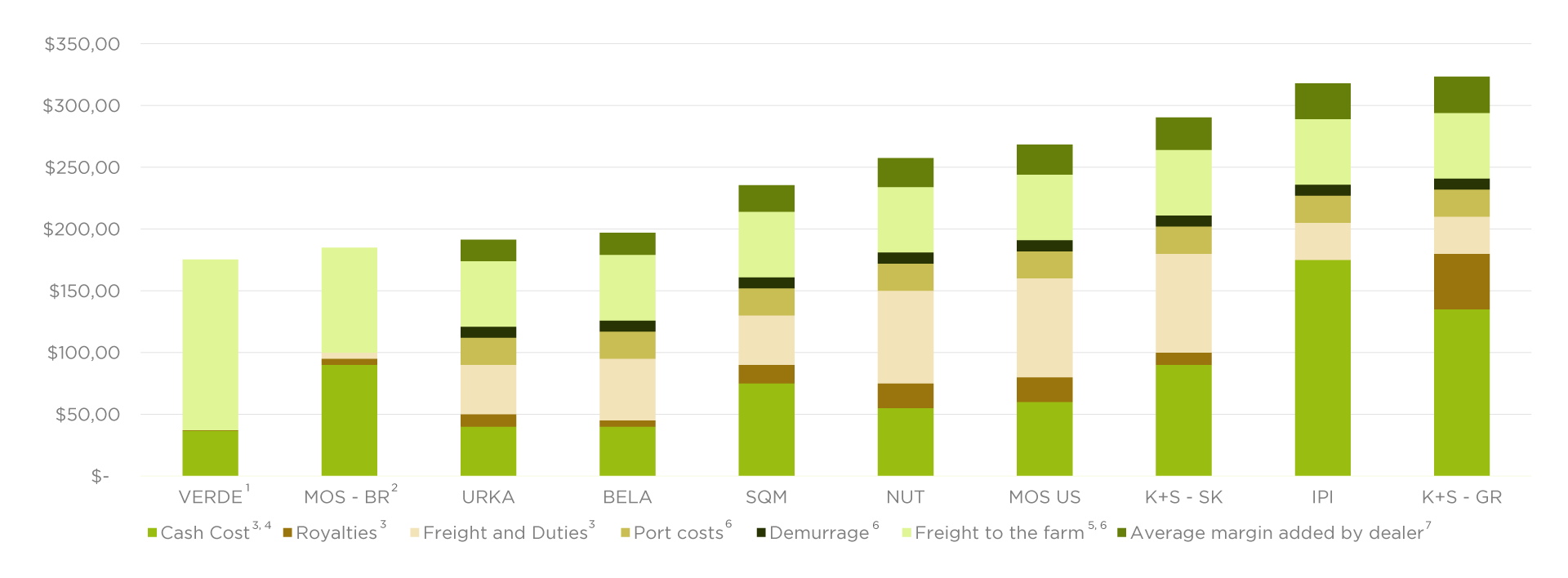

Potash is now 130% more expensive than 2020*

In November 2021 it reached an average price of US$800/t. The largest price rise since 2009

Potash Price (CFR Brazil)

Source: Acerto Limited Report / Agribusiness Intelligence for Latin America

* As of November 04, 2021