Potash is now 221% more expensive than 2021.*

In April 2022, it reached the price average of US$1,200/t. The largest price rise since 2009.

Belarus protests against its dictator, Alexander Lukashenko, and Russia protests against Putin’s decision to invade Ukraine.

Rooting our solutions in nature, we make agriculture healthier, more productive, and profitable for farmers. We work to improve the health of all people and the planet.

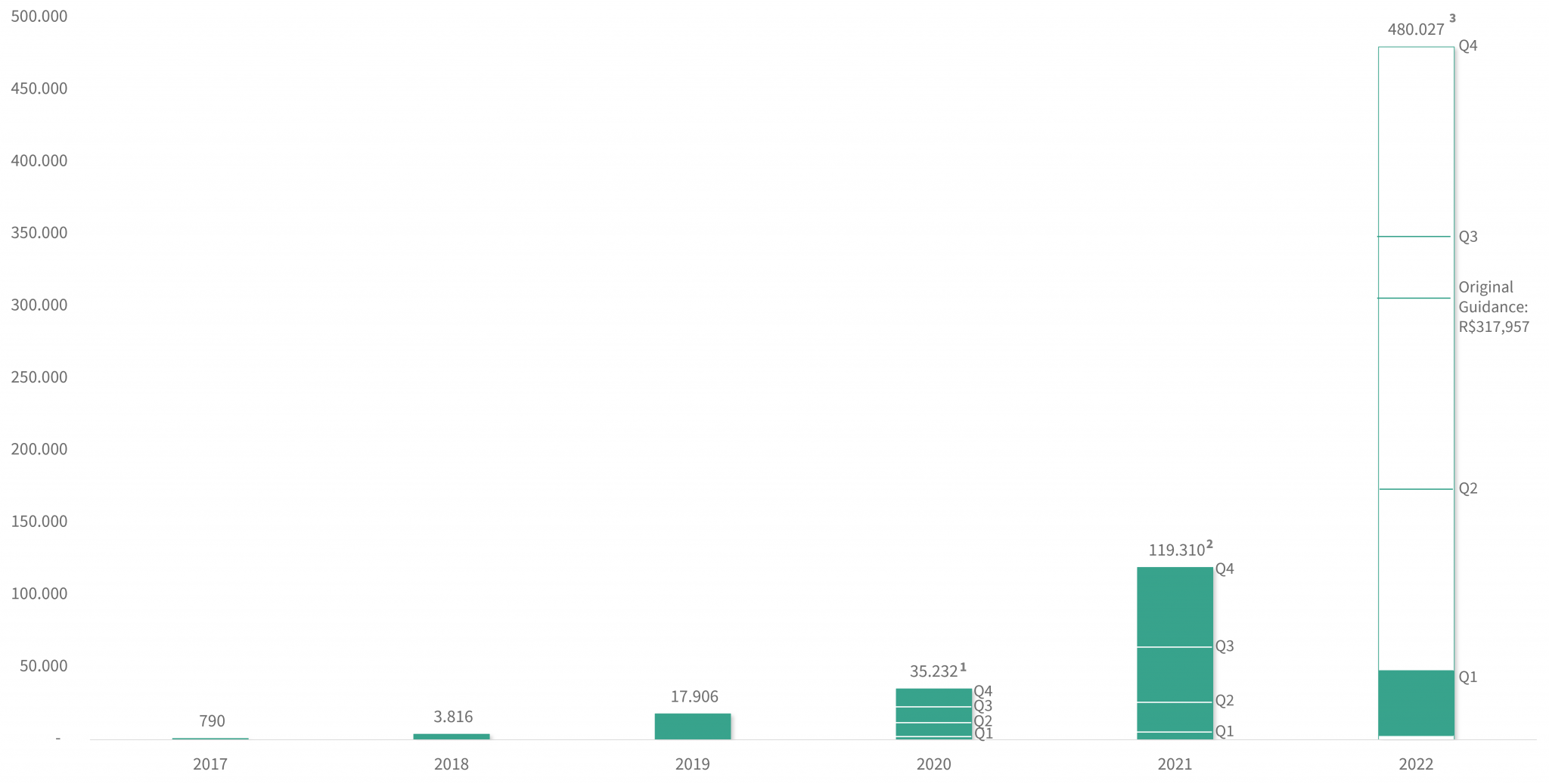

Verde’s revenue per year (R$ ‘000)

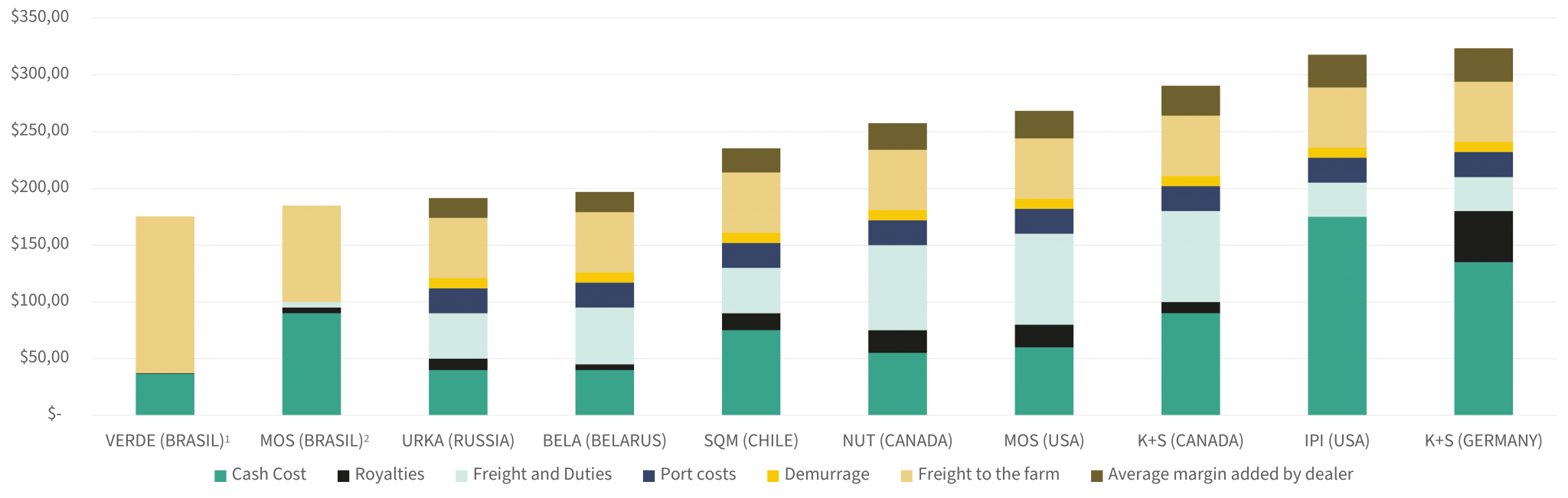

Delivered cost to the Cerrado region, Brazil (March, 2021)

1 – Delivered cost of 600kg of K2O, equivalent to 1 tonne of KCl or 6 tonnes of K Forte.

2 – Freight from Taquari-Vassouras mine, in Rosário do Catete (SE), to Minas Gerais. Currency exchange rate: US$1.00 = R$5.30

3 – Ben’s Fert Playbook, Global Fertilizers. Scotibank, March 2021, page 25.

4 – Operating costs for meeting the market demand of 16.84M tonnes of K Forte. See NI 43-101 Pre-Feasibility Technical Report Cerrado Verde Project, MG, Brazil, page 198.

5 – Weighted average freight for meeting the market demand of 16.84M tonnes of K Forte. See NI 43-101 Pre-Feasibility Technical Report Cerrado Verde Project, MG, Brazil, page 175.

6 – Acerto Limited Report, Agribusiness Intelligence for Latin America. Port costs, Demurrage and Freight to the Farm calculated from Santos (SP) Port to Uberaba (MG), as of August 19, 2021.

7 – Average margin considered as 10% of the sale price.

Our strong board of directors counts with UN World Food Prize winner Alysson Paolinelli, who was also a contender for the 2021 Nobel Peace Prize.

We have a scalable project being developed in a non-dilutive way to shareholders, through accumulated cash flow and debt.

Verde raised over C$60 million over the years, cautiously invested in exploration, project development, production and expansions.

This strategy has been validated by the Company’s profitable and constant growth so far.